Corporate Governance

Corporate Governance

| Fiscal 2022 Objectives | Fiscal 2022 Achievements | Self-Evaluation | Priority Objectives for Fiscal 2023 |

|---|---|---|---|

|

|

★★ |

|

- Self-evaluation: ★★★ Achieved more than targeted / ★★ Achieved as targeted / ★ Achieved to some extent

Basic Policy

Sharp’s basic policy on corporate governance is to maximize corporate value through timely and appropriate management while ensuring transparency, objectivity, and soundness supported by the concept, “Our future prosperity is directly linked to the prosperity of our customers, dealers and shareholders...” as stated in the company’s Business Philosophy.

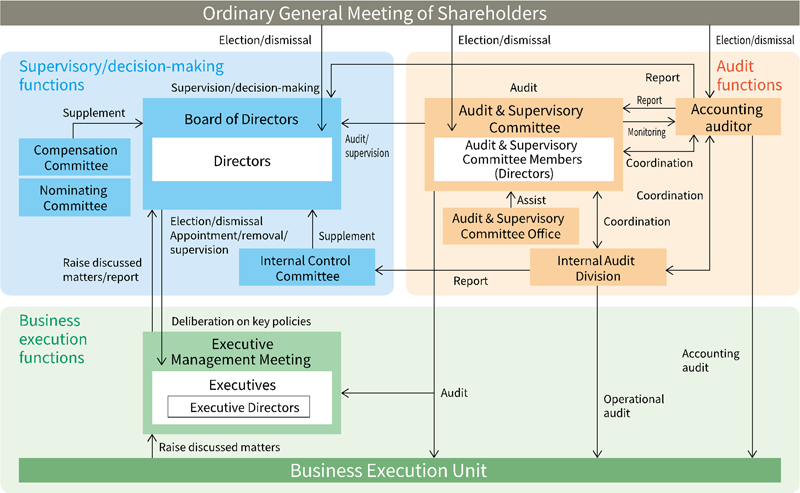

Based on this policy, Sharp is strengthening the supervisory function over the Board of Directors and enhancing the flexibility of decision-making by appointing outside director and operating an Audit and Supervisory Committee.

Sharp has also introduced an executive officer system that clearly separates supervisory and decision-making functions from business execution functions, thereby creating a structure that steadily facilitates nimble and efficient business execution. Further, Sharp is implementing deep-rooted enhancements to individual fields of business and operations by establishing a divisionalized management system in which each business unit assumes responsibility for their earnings, to be regulated by the CEO Office and the Corporate Strategic Planning and Control Group at the head office.

In addition, Sharp has formulated the Sharp Group Charter of Corporate Behavior as action guidelines for all directors, executives, and employees to raise their awareness of compliance, and it is working for its permeation across the entire Sharp Group.

Corporate Governance System:

Supervisory and Decision-Making Functions

Sharp Corporation Board of Directors meetings are held on a monthly basis in principle to make decisions on matters stipulated by law and on management-related matters of importance, and to supervise the state of business execution.

The Board of Directors comprises internal directors who are experts in the fields of business of the Sharp Group and outside directors appointed from talent with high specialism and abundant experience in fields such as social and economic trends and management.

Sharp has established a voluntary Nominating Committee and Compensation Committee as advisory committees to the Board of Directors. The Nominating Committee recommends candidates for directorships to the Board of Directors and the Compensation Committee determines the value of remuneration and bonus packages for directors undertaking a role on the Board of Directors. The majority of members of both committees are independent outside directors and independent outside directors serve as the committee chairs.

Additionally, important matters pertaining to dealings between the parent company group and the Sharp Group that are within the purview of the Executive Management Meeting shall, before any decision is made, be subject to study and approval by the Board of Directors (the majority of who are independent outside directors) with regard to the necessity, reasonableness, and appropriateness of the dealings in question.

In addition, Sharp has established an Internal Control Committee to serve as an advisory committee to the Board of Directors. The Internal Control Committee discusses basic policy, maintenance and operation of internal control and internal audits, reports to the Board of Directors, and, when necessary, refers matters for discussion to the Board of Directors.

Composition of Supervisory and Decision-Making Organs

| All Member (Persons) |

Internal Directors (Persons) |

Outside Directors (Persons) |

Non-directors (Persons) |

Chairperson / Committee Chair |

|

|---|---|---|---|---|---|

| Board of Directors | 7 | 2 | 5 | 0 | Chairperson: President & CEO |

| Nominating Committee | 3 | 1 | 2 | 0 | Committee chair: Independent outside director |

| Compensation Committee | 3 | 1 | 2 | 0 | Committee chair: Independent outside director |

| Internal Control Committee | 7 | 2 | 3 | 2 | Committee chair: President & CEO |

Directors (except Audit and Supervisory Committee members)/ Directors Who Are Audit and Supervisory Committee Members

| All Members (Persons) |

Internal Directors (Persons) |

Outside Directors (Persons) |

Independent Directors (Persons) |

Term | |

|---|---|---|---|---|---|

| Directors (except Audit and Supervisory Committee members) | 4 | 2 | 2 | 2 | 1 year |

| Directors who are Audit and Supervisory Committee members | 3 | 0 | 3 | 2 | 2 year |

Business Execution Functions

The Board of Directors’ rules stipulate matters on which the Board must decide upon. These matters include Sharp’s basic management policy, management plans, other important matters of management, and matters prescribed by laws, regulations, and articles of incorporation.

As for decisions on other matters of management and business operations, these are stipulated in in-house rules such as the Internal Authorization Rules, and the most relevant rules are used to make decisions. For matters that are key to company-wide management and business operations, these are deliberated on at an Executive Management Meeting that comprises Sharp executives (the CEO, executive vice president, and CFO). The meeting convenes in a timely manner, which allows rapid management decision-making.

Audit Functions

The Audit and Supervisory Committee is composed of three directors, all of whom are outside directors with a high level of expertise. Two of them have specialisms to an appropriate extent in finance or accounting. Further, two members are independent directors and one is a full-time member of the Audit and Supervisory Committee. On the Sharp website can be found the “Standards for Independence of Outside Directors,” which stipulates standards for judging the independence of outside directors.

The Audit and Supervisory Committee exchanges opinions periodically with executive directors, the internal audit division, and accounting auditor, and seeks to attain legality, propriety, and efficiency in business execution. Sharp has also established an Audit and Supervisory Committee Office composed of employees with specialisms in specific fields such as accounting and law, which supports the Audit and Supervisory Committee.

Sharp undergoes audits by its accounting auditor, PricewaterhouseCoopers Arata LLC, in order to ensure the reliability of financial documents and other finance-related information. Through audits, Sharp receives proposals on how to make operational improvements.

To preserve the independence of the internal audit division from the business execution divisions, an Internal Audit Division has been established directly under the jurisdiction of the President. It audits the propriety of business execution and the appropriateness and efficiency of management. It also makes defined proposals on operational and business improvements as a means of increasing management efficiency and supporting the internal control system.

Corporate Governance System of Sharp Corporation (as of June 28, 2023)

Management of Related Party Transactions and Others*

Sharp has established the Regulations on Related Party Transactions. Sharp manages these transactions so that they will not adversely affect the company’s finances or business performance.

Sharp has also created a list of related parties. When entering into business with the counterparty, Sharp determines whether or not the transaction should be considered a related party transaction. Such transactions undergo all of the internal procedures that are followed for conventional transactions. In doing so, Sharp assesses the necessity, reasonability, and appropriateness of the transaction terms and conditions. This allows Sharp to exercise prudence when deciding on business deals.

Once a year Sharp verifies the content of transactions specified by outside directors, and the results are reported to the Board of Directors.

- * Related party transactions and management-involved transactions:

Related party transactions are transactions with a company or person having a certain level of connection with Sharp, including Sharp’s officers, subsidiaries, and major shareholders.

Management-involved transactions are transactions that Sharp’s management personnel have introduced or planned.